5-SECOND SUMMARY:

- Artificial Intelligence (AI) is one of the most impacting technologies for the world economy;

- Companies can use AI to Change the way they understand and interact with their customers, offer smarter products and services, and improve and automate critical business processes.

- Xpand IT takes two approaches to this technology project: AI as-a-Service and Data Science. Learn how to take advantage of Artificial Intelligence through use cases.

Artificial Intelligence is one of the most popular technologies in recent years (for different reasons). Much has been discussed about this technology: either we praise the improvements it allows in areas such as health, retail or industry, or we fear that all these technological advances that AI (Artificial Intelligence) has allowed in recent years will extinguish a significant number of jobs on which our society currently depends.

We can confidently say that you will have crossed paths with the concept of Artificial Intelligence at some point in your life. According to the Oxford English Dictionary, we can define it “as the theory and development of computer systems able to perform tasks normally requiring human intelligence”. As such, and because this technology simulates and reproduces some of the human behaviours, we can recognise the enormous disruptive impact has on our society. We know that Artificial Intelligence (AI) continues to transform every job, business, and industry in the world.

Regardless of the advantages or potential limitations that artificial intelligence (AI) may have, it’s undeniable that this is one of the most impactful technologies for our economy. There are countless opportunities for companies to take advantage of the best that Artificial Intelligence (AI) has to offer. The proof is the growing number of pioneers in AI – examples include Microsoft, GAFA [Google, Amazon, Facebook and Apple], IBM, Alibaba, Tencent, JD.com and Baidu – that continue investing in Research & Development in different areas of AI (Artificial Intelligence) and that with their investment, prove the viability of the technology for “real life” cases.

Indeed, some of the opportunities that companies can take advantage of by integrating AI into their digital solutions are:

• Data analysis and decision-making enhancement;

• Task automation to optimise operational efficiency;

• Personalised customer service, available 24/7;

• Personalisation of services, products, or content based on user behaviour and preferences;

• Reduction of operational costs.

Use cases: how to take advantage of Artificial Intelligence?

The fact that several companies worldwide are investing and applying – in different ways – this technology in their business realities shows the relevance that AI has for the business fabric of our economy and the potential to revolutionise companies’ business models. How, then, can companies start? What are the use cases that you can start implementing in your reality?

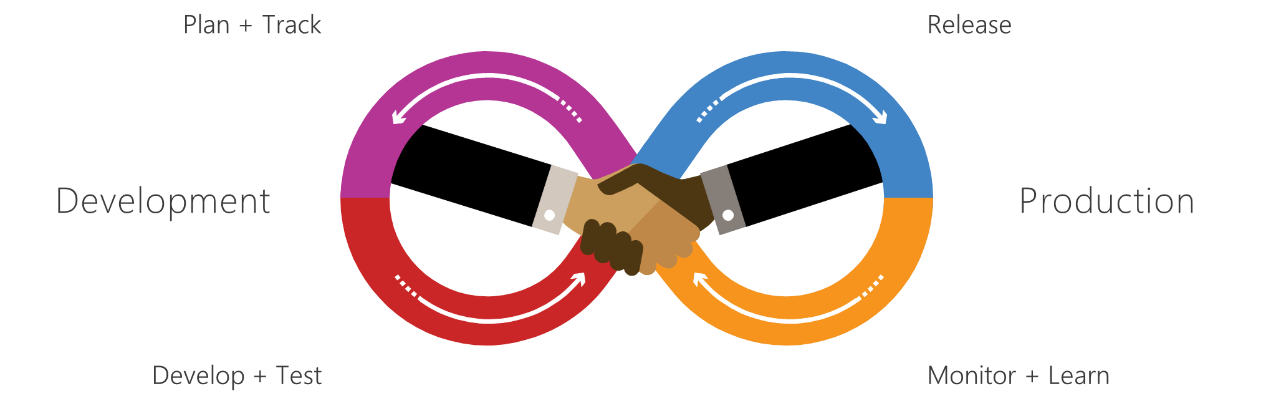

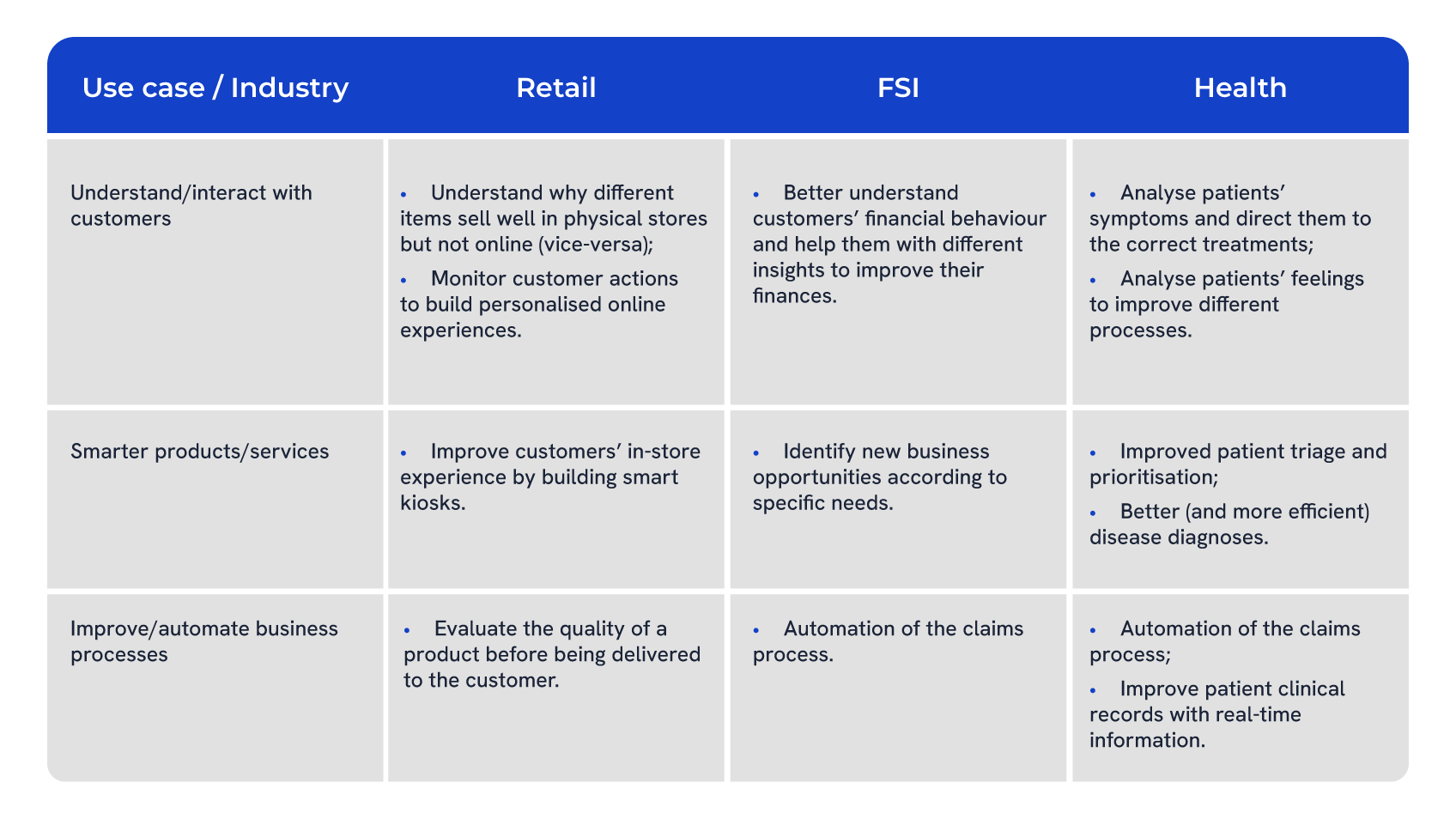

Futurist and author Bernard Marr in his book Artificial Intelligence in Practice – How 50 successful companies used AI and Machine Learning to solve problems, states there are three different use cases that, while they may overlap, are important in helping segment and identify implementation opportunities for this technology. Companies can, then, use AI to:

• Change the way they understand and interact with their customers;

• Offer smarter products and services;

• Improve and automate critical business processes.

Any use case that we identify may fit into at least one of the above purposes. But we are also able to map different use cases to implement with this technology, depending on the industry in which you operate:

While this is not an exhaustive list of existing use cases for AI technology, it does help companies map out not only why they want to implement this specific technology but also the specific problems they will solve and the needs they will address.

Artificial Intelligence at Xpand IT

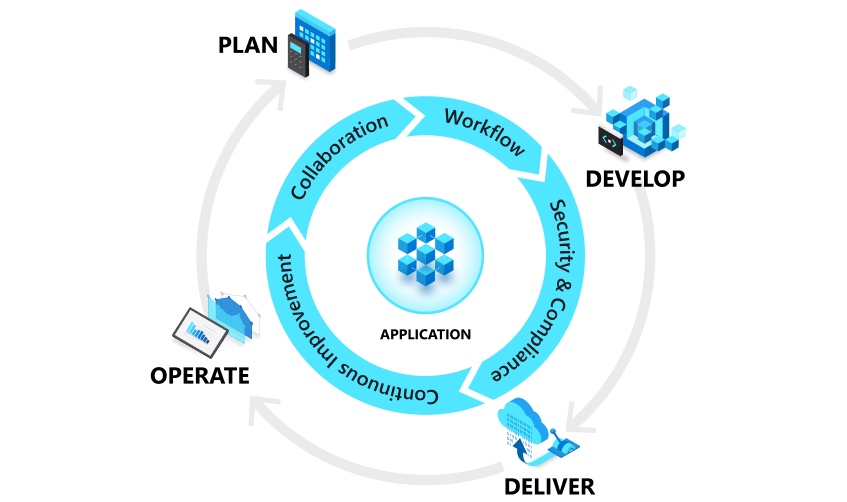

For several years now, as a technology consultancy company, we have been betting on Artificial Intelligence (AI) with the purpose of finding real scenarios where this technology can effectively make a difference in the daily life of companies. Our approach aims to be holistic and fully aligned with the organisational goals of our clients, where the starting point is an analysis of business needs. We identify challenges and organisational goals, ensuring that the proposed AI solutions match our client’s needs. A detailed viability analysis, along with a technological mapping, ensures we think about and propose the most suitable AI solution, always with an emphasis on security and ethics.

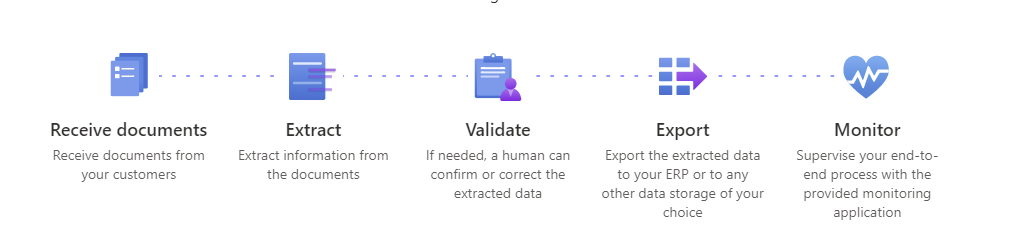

The implementation involves effective data engineering, ensuring high-quality data, the development and training of AI models, and prompt engineering for more precise and contextualised responses. In all our projects, we adopt solid governance for the responsible use of technology, and our focus is on creating intelligent experiences. With a continuous focus on the evolution, monitoring and control of AI solutions, we ensure these are aligned with the strategic goals of clients and with the industry’s best practices.

If you have considered implementing this technology in your company but face challenges in defining the starting point, we can help you identify specific AI implementation opportunities in your business.