Analytics Solutions

for Banking and Insurance

Advantages

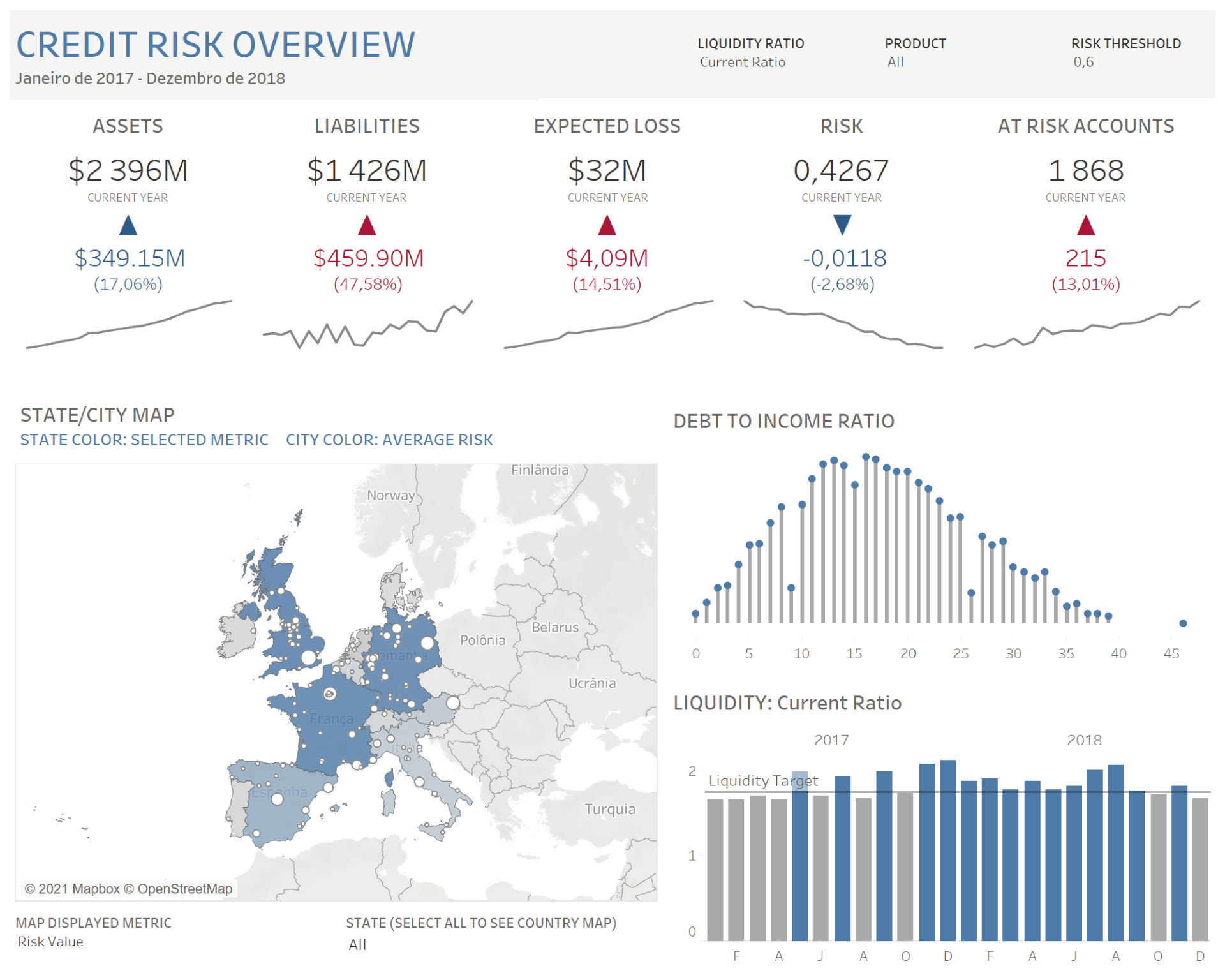

Changes in the main trends in society have an impact on the banking and insurance sector, requiring constant adaptation. An analytics solution for banking and insurance that allows the various departments the ability to respond to different questions according to the changing reality is essential. In addition, the use of analytics solutions allows a complete overview of each customer, enabling greater attention to their specificities as well as a more complete assessment of their behaviour. Finally, risk analysis is a success factor where business intelligence and analytics play a major role.

Use cases | Banking and Insurance

The regular provision of information about key indicators, whether relative to volume, production or risk, enables the monitoring and evaluation of the rate of achievement of objectives. When applied to the entire structure, it provides a complete overview for each player, regardless of their position.

Customer segmentation allows the achievement of several objectives, which may be related to relationship differentiation, marketing campaigns or other purposes. The implementation of segmentation can be carried out through business rules or with the application of specific models, but in both cases it requires the organisation of relevant characteristics and indicators that characterise customers.

Understanding how a customer portfolio evolves at a geographic level can provide valuable insights, empower organisational growth and influence the marketing and sales strategy. This type of analysis is only possible by building a view of the customer, including the patterns of products they buy as well as other relevant indicators of engagement.