Study

Discover today’s trends from worldwide banking mobile apps with this banking industry study

The number of smartphone users worldwide is over 2.5 billion, and it is clear that penetration rates are also increasing. In 2018, consumers worldwide downloaded a total of 205.4 billion apps.

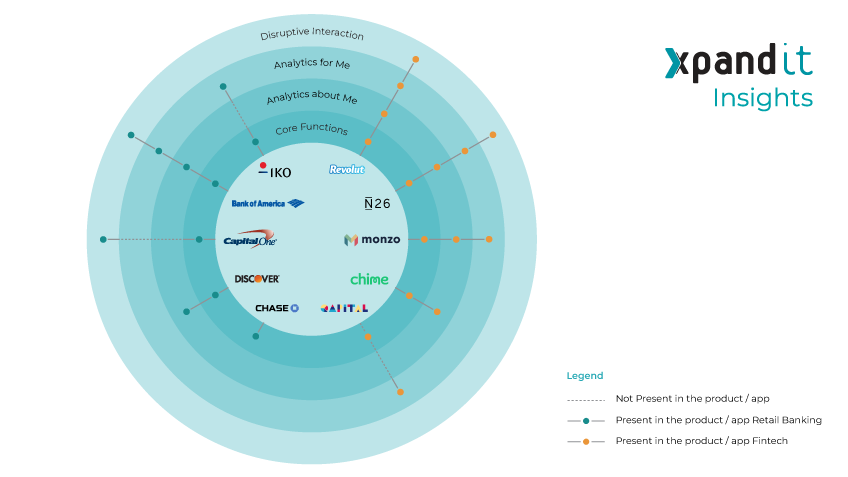

The banking industry, although enjoying this technological advancement in some ways, has remained resistant to change in the way it does business and the way it interacts with its customers. However, considering user expectations and the experiences that new entrants, like fintechs, are offering, banks are now realising the need to change as our cultural framework changes.

The Challenges

Filipa Moreno, Digital Xperience – Xpand IT

The Results

Sergio Viana, Partner & Digital Xperience Lead – Xpand IT

Banking Industry Challenges

With increased competition and a new landscape, there are various challenges the banking industry faces if you look at how the market has evolved and what might come in the future. These can be summed up in four broad themes:

Digitalisation

Digitising processes can help banks reduce costs and, more importantly, take advantage of the opportunities that emerge from the implementation of these new technologies.

Security

Security is still one of the main concerns of customers when talking about banking and their daily operations. It’s fundamental to ensure security while making sure we’re complying with all regulations in place.

Innovation

Implementing new technologies that help you gather useful insights about your customers guarantees that you keep innovating, keep pace with market trends and that you get to better engage with your customer, offering increased value for them.

Engagement

Data-driven insights are an important tool to beginning engagement with your customer and presenting truly relevant offers as well as targeted products.

A business that understands the importance of the Open Banking will also understand the importance of working with new paradigms, challenges and trends in the Banking Industry. (…) This short, practical report will, therefore, be a powerful tool for retail banking stakeholders to make the necessary steps to a more customer-centric approach in the mobile banking arena.

The Banking Industry, as any other sector, needs to implement strong technological investments, if it wants to maintain its offer and be at the top of the market (…) This study about the Banking Industry created by Xpand IT, a customer-focused specialised tech company focused on achieving excellence, will be an essential tool for strategic decisions related to the adoption of digital platforms.